Factors That Affect Your Credit Score

By Joan Whetzel

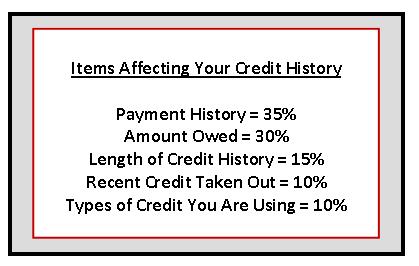

Checking on your credit score may not seem like it’s all that important a thing to do. But when you consider that your credit score affects your ability to purchase a car or home, or to get credit to buy that high-end, flat screen TV you’ve always wanted, well, then it’s worth it to see where your credit score is at and how you can fix any problems. There are 5 key factors that impact your credit score: your payment history, the amount of money you owe, the length of your credit history, any recent applications for credit, and whether your credit accounts are revolving credit or installment credit.

Your Payment History

Payment history generally makes up about 35% of your credit score. That may vary slightly depending on the reporting agency. Since this plays the biggest part in deciding your credit score, the longer your credit history, the more important it is that you make sure there are few or no late payments. A long history of on time payments – at 35% of your score - makes your credit score look good. But, even if you have a few late payments, it won’t affect your score too badly. It all depends on how long it’s been since the last late payment (the longer the better), how many payments have been late, and the size of the slip-up (from one late credit card payment at only a few points on up to a bankruptcy, which will cost you big).

How Much You Owe

This one comprises about 30% of your credit score. What makes this factor so important is that the more you owe, the less likely banks will be to lend you more money. Your debt level determines how much more credit is available to you each time you fill out another credit application. It’s based on the likelihood that you can stretch your income a little further to make the payments.

The Length of Your Credit History

The length of time you’ve had a credit history counts for a bit less, coming in at only 15 percent of your credit score. The length of your credit history sets up a pattern of payment behavior. For those having no credit history – which makes it harder to establish credit – and those who have only had one credit card but no major credit (car payment or mortgage) will find that their credit scores are lower than they might like it to be. The longer your credit history, the more information creditors will have to base their lending decisions on.

Recent Credit

At 10% of your credit score, recent credit takes into account any recent debts that you’ve taken on. Did you just buy a car? Apply for credit to purchase that entertainment system? Take out a handful of credit cards? The more credit you’ve taken on recently, the less likely any new creditors will be to grant you a new line of credit.

Revolving Credit or Installment Credit?

The type of credit you’re paying off accounts for 10% of the score. Bank loans for cars and homes are of the installment variety and credit cards are considered revolving credit. With credit cards, even though you may have paid off the debt, your line of credit remains open to use again and again. People with credit from a variety of sources have higher credit scores.

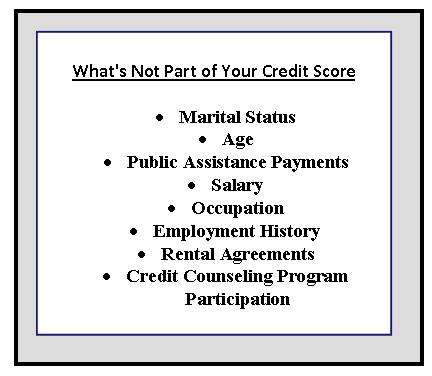

What Is NOT Included in Your Credit Score

There are several factors that don’t come into play when calculating your credit score. Those factors include: marital status, age, being on public assistance, salary, occupation, your employment history, any rental agreements you’re paying on, or your participation in credit counseling. While your salary won’t show up in your credit rating, it will be taken into account by creditors because it affects your ability to pay.

When looking at your credit score, remember it’s all based on the numbers, the statistical data of your credit you’ve received so far and your ability to make the payments. It doesn’t look at you as a person. So unless you know the banker or loan officer personally, your “character” won’t count for much in the decision to lend you money. So the best way to make sure you can get the line of credit you need, when you need it, is to make sure your credit score is good.

Resources

A Good Credit Score. The 5 Factors Affecting Your Credit Score.

http://www.agoodcreditscore.com/

Carrns, Ann. The New York Times. What Factors Affect Your Credit Score.

http://bucks.blogs.nytimes.com/2013/01/16/what-factors-affect-your-credit-score/